Do I need to file a claim with my insurance provider for the anesthesia services?

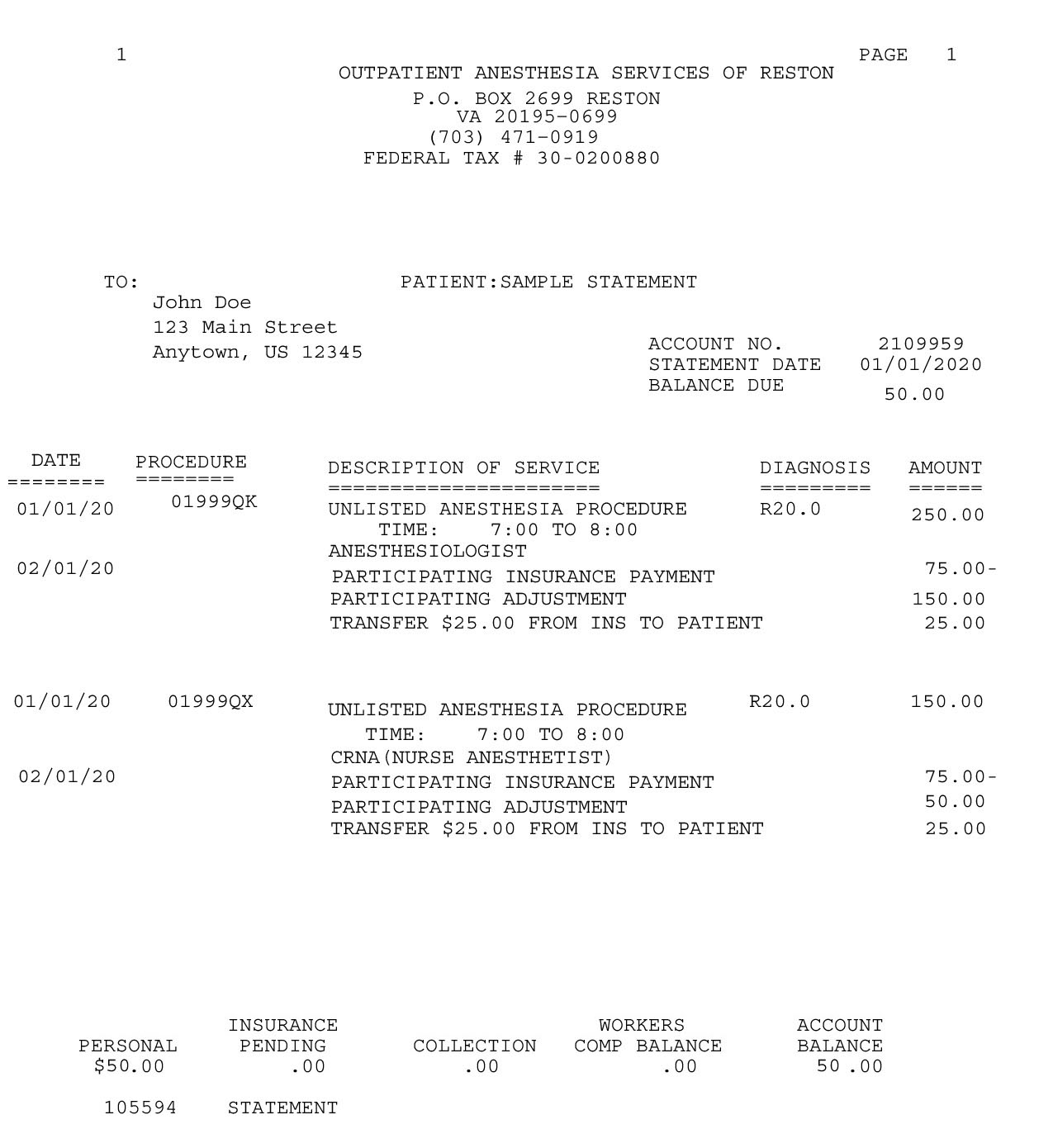

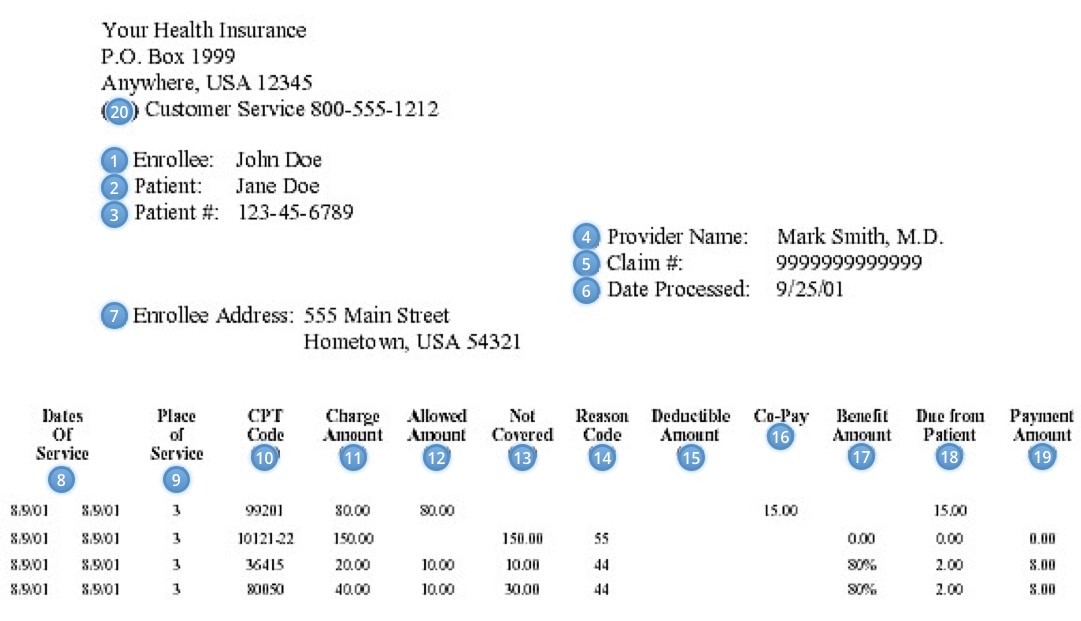

We will file an insurance claim on your behalf to the primary insurance on file. If there is a secondary insurance on file, we will also file a claim for the amount not paid by your primary insurance. If there is no secondary insurance on file, you will receive a bill for any co-payment or deductible as determined by your primary insurance company.